Accounts

Accounts represent a sum of allocations of value within your enterprise. The General ledger subsystem performs transactions on accounts, either increasing or decreasing their value based on the type and amount of the transaction being performed. Accounts can represent the parents of multiple sub-accounts, creating a multi-level tree of accounts called your Chart of Accounts.

Every account defined in the system must be assigned a General ledger category which determines whether the account is a balance sheet account or a profit and loss account. The general ledger category also determines whether the account is a credit account or a debit account.

Every account has an Opening balance and a Current balance, as well as a breakdown of the values of transactions performed on the account for each month and quarter of the financial year.

Every account is identified within Accentis Enterprise using a unique, alpha-numeric, user-definable Account code. All functions within the system that deal with accounts use the account’s code.

Every transaction that occurs with any account is recorded as a journal transaction that shows the date, amount and corresponding account that was involved in the transaction.

- Account codes are FlexiCode

- Accounts can be assigned to Profit centre

- Current balance, opening balance, Prior year balance stored per account

- Option to suspend transactions form being performed on an account

- Account duplication facility to enable fast adding of new accounts

- Annual budget figures can be entered for each account

- Optional bank account information can be specified for an account

- Monthly and quarterly balances stored for each account and displayed in a convenient format in the account management form

- Account codes can be constructed using a user-defined format

Module: General ledger

Category: Accounts

Activation: Main > General ledger > Accounts

Form style: Multiple instance, WYSIWYS, SODA

Special actions available for users with Administrator permissions:

- View and edit deleted accounts with the Allow display of deleted records menu option.

- Change the User ID of the Entered by field of memos.

- Edit memos entered by other users.

Database rules:

- None

Reference: Text(11/12), Mandatory, FlexiCode, WYSIWYS

This is the code that is used to identify the account throughout the system. The code used here should be long enough to make it unique across all Accounts, but short enough to make it convenient to use as a quick identifier. Local currency accounts can be a maximum of 12 characters in length, while foreign currency accounts can have a maximum length of 11 characters to allow for a foreign exchange account to be created using a matching code. You can use any text or a number to represent account codes. Whenever you are expected to select an account on a form, it is the account code that you will be required to enter.

The account code is a FlexiCode. This allows you to modify the account code while still retaining all previous internal references and links to that account. If you change an account code, you will notice the new account code appear on all previous forms that used that account.

You can select any sort of account-coding scheme you like. There are no restrictions as to the format of the account codes that are used. The powerful searching and reporting facilities available make it easy to search for an account code regardless of the coding scheme that is used.

Reference: Text(50), Mandatory, WYSIWYS

This is the name used for the account and is used for reference purposes only. Whenever the account is used on a form its name is usually displayed along with the Account code. The name of an account should be long enough to avoid ambiguity between accounts but still short enough to be displayed adequately in forms and reports.

Reference: Select from list, Mandatory, HotEdit, WYSIWYS

This specifies the Profit centre that have been assigned to an account. Every account must be assigned to exactly one profit centre. An account’s profit centre is for reference purposes only and serves to further categorise the account.

Reference: Select from list, Mandatory, WYSIWYS

This is the General ledger category in which the account belongs. An account must be assigned to exactly one General ledger category. The Ledger category to which an account belongs determines whether or not the account is a Credit account or a Debit account. Once the Ledger category has been selected it cannot be changed if any transactions have been performed for the account.

There are 8 General ledger categories from which to choose, and each Ledger category is classified as either a Balance sheet account or a Profit and Loss account.

- Asset

- Balance sheet, Debit account - An Asset is something of value that your business owns. This may be something physical as in a piece of plant and equipment, or it may be something virtual as in a debt from another business or intellectual property

- Cost Of Sales

- Profit and Loss, Debit account - The cost of sales represents the actual cost of items sold to your customers. The value received from the sales would be classified as income, and the difference between the two is your gross profit (not accounting for any other expenses required to run your business)

- Equity

- Balance sheet, Credit account - Equity is an amount that is owed to the owners of the business (usually its shareholders). It is really just a sub-classification of a liability. The net profit at the end of a financial year is transferred to an equity account in order to make the balance sheet accounts all balance to zero

- Expense

- Profit and Loss, Debit account - Expenses are generally the costs incurred in the day to day running of your business including items such as payroll, rent, office supplies and advertising.

- Income

- Profit and Loss, Credit account - Income generally represents a net inflow of value to your business. Common examples of income are the value of sales or interest from a bank account

- Liability

- Balance sheet, Credit account - A liability is an amount that is owed to another person, business or organisation. Liabilities are usually always virtual in their nature. Common examples of liabilities are credit card accounts, loans and customer deposits paid.

- Other Expense

- Profit and Loss, Debit account - This is a further classification of expenses that would be considered extraordinary expenses

- Other Income

- Profit and Loss, Credit account - This is a further classification of income that would be considered extraordinary income

Reference: Select from list, Mandatory, WYSIWYS

The account type specifies whether the account is a group (parent) account or a normal account. Every account must be either a group account or a normal account.

A group account is an account that can be assigned to the Parent account field of other accounts. The balances displayed for a group account are equal to the sum of the corresponding totals of the account’s sub-accounts.

A normal account is an account that is not a group account. Account transactions can only be performed on normal accounts, not on group accounts.

Once the type of account has been selected it cannot be changed if any transactions have been performed for the account.

Reference: Account Field Type, QuickList, WYSIWYS

This is the Account code of the parent or group account to which the account belongs. This can be any valid account code of a group account but it must have the same General Ledger category as the current account.

An account does not have to have a parent account. If an account has no parent account, it will be displayed at the top level of the Chart of Accounts and will be shown regardless of whether or not the Display in the Chart of Accounts option for the account is selected.

Reference: Select from list, Mandatory, HotEdit, WYSIWYS

The currency field indicates the currency in which the account is specified. Every account must deal in only one currency. Once the currency for an account has been specified, it cannot be changed. All monetary values displayed for the account are displayed in the selected currency.

A currency is talked about as being local or foreign. This distinction is based on the local currency displayed on the Currencies form. Every time an account is created specifying a foreign currency, a second account is also created. This account is known as a foreign exchange rate account and is internally linked to the original account for the lifespan of the account. The foreign exchange rate account is created with the same details as the original account with the following exceptions.

- $ is appended to the end of the specified account code

- (Exchange) is appended to the end of the account name

- The Disallow use of this account in transactions flag is set and a Disallow use reason of "Exchange account" is added

- Opening and previous year balances are set to $0

- Annual budget is set to $0

Once the foreign exchange rate account has been created, only the Opening balance and Prior year balance, Annual budget and Comments fields can be modified for the account. As this account is linked to and required by the original account that was created, it cannot be manually deleted. Deleting the original account will cause the Foreign exchange rate account to also be deleted. Modifying the Accounts, Name or Parent account field of the original account will also cause the matching field in the Foreign exchange rate account to be modified.

Reference: Currency

This represents the balance of the account before any amounts have been transacted for the account for the current financial year.

Generally only balance sheet accounts will have an opening balance, however if you have converted from another business management system part way through a financial year then this value represents the current value of the account when the conversion took place.

If the account is a group account then this value is calculated as the opening value of all of the associated sub-accounts and cannot be modified manually.

Reference: Currency

This represents the balance of the account at the end of the previous financial year.

Because profit and loss accounts have their balance reset at the start of each financial year, they do not have an Opening balance (unless a conversion from a previous accounts system has happened during the year) and therefore the previous year balance shows their value at the end of the prior year.

For balance sheet accounts, this value is generally the same as the account’s Opening balance value. The exception to this is if a conversion from a previous accounts system has happened during the year in which case they can differ.

If the account is a group account then the Prior year balance value is calculated as the prior year balance value of all of the associated sub-accounts and cannot be modified manually.

Reference: Currency, Read-only

This is the current balance of the account and is calculated by adding the account’s Opening balance to the net amount transacted to the account in the financial year to date. This amount cannot be modified manually – only the account’s opening balance can be modified manually.

Reference: Currency

This represents an annual budget figure that can be allocated to the specified account. It is only used for reference and reporting purposes and can be any amount you like. The exception to this rule occurs when monthly budget figures are entered for an account. In this situation, the annual budget figure will be the sum of all monthly budget figures and cannot be changed.

Reference: Quantity, Read-only

This figure represents the average exchange rate used by all transactions that make up the Current balance of the account. The figure is calculated using the current balance of the account and the balance of the Linked exchange account. The average exchange rate figure cannot be edited and is only visible when viewing foreign currency accounts.

Reference: Currency, Read-only

This figure represents the local currency equivalent of the account's Current balance. The figure is calculated using the current balance of the account and the Avg. exchange rate. The Local equivalent figure cannot be edited and is only visible when viewing foreign currency accounts.

Reference: Memo, Expandable, WYSIWYS

This field allows the entry of free text, including as much or as little additional information about the account as you like. This field is only used for reference purposes and serves to clarify the existence or usage of the account to anyone who views the notes.

Reference: Date, QuickList, WYSIWYS

This is the date used to lock a specific account by disallowing transactions having dates prior to the date specified here.

This is an important feature: once financial reports have been finalised, it is important that figures are not changed inadvertently.

Any user attempting to perform a journal transaction on a locked account for a date prior to the account lock date will not be able to complete their operation and will be told the reason why. This includes any indirect journal entries such as a Dispatch or a Receive for a prior date.

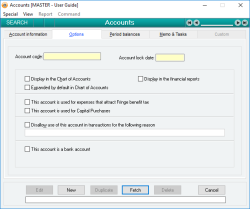

Reference: Yes/no

This option specifies that the account should be shown in the appropriate position in the Chart of accounts form. If the option is not selected, the Chart of accounts form will not show this account in its accounts tree, however the balance of the account will still be included in the displayed balance of the account’s Parent account.

This option is typically used for individual Customer or Suppliers accounts that are not usually of relevance in the Chart of Accounts.

Reference: Yes/no

This option specifies that the account should not be displayed in any that are generated unless the account is specifically included.

The financial reports system can automatically generate a list of accounts that belong to a particular Parent account, and this option specifies that the account should not be included in that automatically generated list. If a financial report specifically includes an account by its Account code, then it will be displayed in the report.

Reference: Yes/no

For group accounts, this option specifies that the account should be displayed as an expanded tree by default when shown in the Chart of accounts form. Otherwise, the account will be displayed by default as a closed tree, hiding the sub-accounts, until it is opened by the user viewing the chart of accounts.

This option is disregarded if the Type is not a group account or the account’s Display in the Chart of Accounts option is not selected.

Reference: Yes/no

This option specifies that expenses attracting Fringe benefits tax are assigned to this account. Setting this option will NOT cause Fringe benefits tax to be automatically accrued.

Reference: Yes/no

This option specifies that Capital Purchases are assigned to this account.

Reference: Yes/no

This option specifies that the account is not to be used for any General ledger transactions until the option is turned off. When this option is selected, you are given the opportunity to enter a reason why the account’s usage has been disallowed.

If a user attempts to use the account in any way that would generate an account transaction for the account then an error message will displayed informing them that the account has been disabled. The reason why the account has been disabled (entered in the Disallow use of this account in transactions reason field) will also be shown to the user.

This option is used when you do not want the Current balance of the account to be further adjusted for any reason, regardless of the date of the transaction.

Reference: Text(30)

This is the reason why the account’s use has been disallowed. This field is only available if the Disallow use of this account in transactions option has been selected and should contain text that you want users to see if they attempt to perform any transactions on the account when its use has been disabled.

Reference: Yes/no

This option specifies that the account represents a Bank account and as such, has bank account details specified for it. To specify the bank account details for the account, click on the bank account details button while in Edit mode.

The bank account details for an account are generally only used for reference and reporting purposes. However, if the account has been specified as the Drawing account in a Payment, then the account details may be used if an electronic remittance is required for the payment.

A group account cannot be set as a bank account.

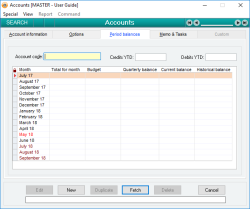

The Monthly balances list for an account shows the following information

- Month

- This is the month to which the following values relate.

- Total For Month

- This is the total amount transacted for the specified month of the current financial year. If the account is a credit account (i.e. the account’s Ledger category is Liability, Equity, Income or Other Income) then this value is equal to the credits minus the debits for the month. If the account is a debit account (i.e. the account’s Ledger category is Asset, Expense, Cost of Sales or Other expenses) then the value is equal to the debits minus the credits for the month.

- Budget

- This is the monthly budget amount for the specified month of the current financial year. This figure is freely enter-able. If a budget figure is entered for any month on the account, the Annual budget for the account will be set to the total of all monthly budget figures and cannot be changed. Not all months need to contain a budget figure. For more information on budgets, see All about budgets in Accentis Enterprise.

- Quarterly balance

- This is the subtotal of the Total for month values for each quarter of the financial year.

- Current balance

- This is the actual balance of the account as at the end of each of the specified months and represents a running total of the Total for month values. For balance sheet accounts, this value includes any Opening balance for the account.

- Historical Balance

- This value is the Total for month value for the account in the previous financial year.

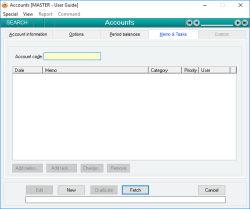

The account memo section allows you to enter an unlimited number of memos to record historical events and facts about the account.

- To add a new memo, click on the New memo button to display a form that will allow you to enter the date, the user and the memo text

- To edit an existing memo, either click on the Edit memo button or double-click on the list entry

- To delete a memo, click on the Delete memo button

Memos cannot be edited unless the account form is in Edit mode.

Reference: Menu

If set, this will display records that have been set as “Pending delete”. This means that a user has deleted them, but because they are linked to other data and historical records, they are not able to be properly deleted and are put into a “recycle bin”. Under normal circumstances you won’t see these records but the option to “Allow display of deleted records” will make them appear while this window is open. If you close the window, and reopen it, you will need to select the “Allow display of deleted records” option if you wish to see the pending-deleted records again.

Note: Once a record has been permanently deleted (that is, there are no linked records and the data has actually been removed), this option will not show those records.

See Pending delete for more information.

Reference: Menu

This will display the list of transaction that this account has been involved in. Filters are available that help to narrow down the information that is displayed.

For more detailed information, run the report SA1628.

Reference: Menu

This option simply refreshes the display of the account data. For example, you may have the window on the screen and have modified the data on another screen and now want to see the current (refreshed) results. This action is the same as pressing F5, or just re-fetching the data.

Last edit: 23/01/23